Insurance loss runs are documents that show your insurance claims throughout the history of your business. Want to know more? Keep on reading!

Kymberlin earned her Bachelor of Arts in Creative Writing from Pacific University in 2020 and resides in Portland, Oregon.

WRITTEN & RESEARCHED BY Kymberlin Bush Kymberlin earned her Bachelor of Arts in Creative Writing from Pacific University in 2020 and resides in Portland, Oregon. Expert Contributor

Our content reflects the editorial opinions of our experts. While our site makes money through referral partnerships, we only partner with companies that meet our standards for quality, as outlined in our independent rating and scoring system.

Are you a small business owner wondering what insurance loss runs are and what do they have to do with you? Have no fear!

Despite the vague name, insurance loss runs aren’t too difficult to understand once you get to know the ins and outs of these reports. After you’ve finished this article, you’ll know what insurance loss runs are (and what they look like), when you might need them, and how/where you can get one.

Table of Contents

An insurance loss run is a report used to document the insurance claim history of your business. They are called “loss run reports” or “insurance loss runs” interchangeably. Loss runs are used to determine your business’s risk to insure.

Loss run reports can help you not only evaluate your own risk as a business but also help you negotiate premiums with insurance companies whether or not they already insure your business.

An easy way to think of loss run reports is as a credit score but for the insurance world! In the same way a financial institution would look at your credit score to understand the credit risk you posed as a potential client, an insurance company can look at your loss run reports to determine how much of a risk your business would be to insure.

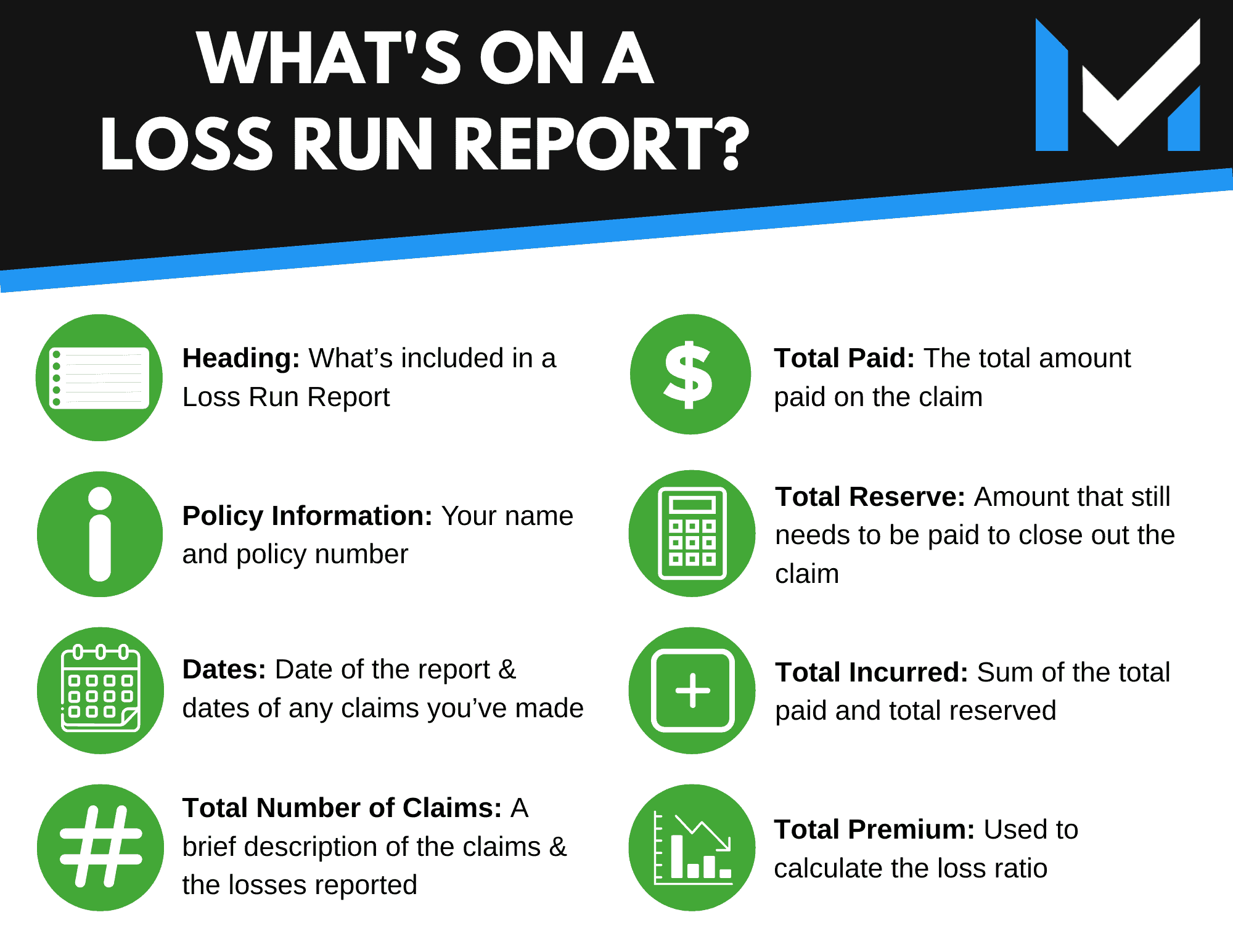

When you look at your loss run report it will contain the following information:

There are several reasons why you might need a loss run report.

The first and most common reason for requesting a loss run report is that you want to shop for insurance. Business insurance for small businesses and startups can be expensive, so shopping around can net you a great deal. Since a loss run report is your small business’ insurance history, it demonstrates whether or not you are a good investment. If you are shopping for insurance and have previous insurance history, a loss run report will often be required because it is the insurer’s way of measuring their potential risk.

You can also use your loss run report as a negotiating tool for lowering your insurance premiums!

Think about your loss run report like your driving record. With car insurance, if you go a certain number of years without any accidents or tickets, you are often rewarded with a discount. In a similar way, if you can show your current or potential insurance providers that your business has a track record of little or no claims, you’re proving that your business is safe and low-risk, which can often result in better rates and premiums.

You may personally want to see a loss run report if you are interested in analyzing the safety risks within certain departments or your entire business as a whole. These reports can also show you which claims are still open and may require follow-up.

If your business is risky and involves accidents and injuries, lawsuits and claims, a loss run report is also a way to gather data about your business. Is there one department that is routinely injuring itself more than other departments? This kind of information can help you identify problem areas so you can implement better safety practices to reduce the chance of future accident and injury claims.

Most states require insurance companies to send you the requested report(s) within 10 days of the original request.

Because this 10-day time frame is a law, you can contact the State Insurance Department if you believe that your insurer may be trying to avoid sending your reports or if you have not received them within the specified amount of time.

Now that you have a better idea of what an insurance loss run is, you might be wondering how you can get one. The list below will walk you through the recommended steps for acquiring a loss run report for your small business. Keep in mind, while the reports are similar, they are specific to each insurer, so if you have had multiple insurance providers in the past, you will want to request a report from each one.

The first step is to ask! Contact your account manager, insurance broker, agency, or insurance provider directly via email/phone to make a request for a loss run report.

Once you have made contact, you need to give your insurance provider three important pieces of information:

As mentioned above, most states have laws that require an insurance company to respond to your request within 10 days. The time it takes for you to receive your report will depend largely on your insurance company.

With the different names and vast amounts of information these reports can contain, it might seem like insurance loss runs are only there to make your life more difficult as a small business owner. The opposite is actually true. Requesting loss run reports can help you determine the risks associated with running your business, how to mitigate them and make your workplace safer, and even help you negotiate a lower insurance premium!

Use this tool to your advantage: If you have a pristine claim history, use that as a bargaining chip and see if you can land yourself a competitive rate. If you don’t have a pristine claim history, can you determine areas of growth needed for your company?

There are many ways a business can make good safety choices to avoid claims, which is the best way to improve your claim history.

Train workers on how to properly use equipment and offer classes and incentives for staying knowledgeable on the latest safety practices. Show proof of security system installation on your buildings, as well as proof of updating fixtures and following fire codes. Look for patterns in your loss run and determine what solutions could prevent those claims from happening in the future.

As with all forms of insurance, the more claims you have, the higher your premiums may become. Every accident (at fault or not) that brings a claim to your insurance company’s attention will affect your rate and loss run report. While you can’t prevent every accident, there are steps you can take to make sure you run a safe business and have a stellar insurance loss run report.

Like any tool of the trade, insurance loss runs can be a little tricky to navigate at first, but now that you’ve read this article, you’re ready to take them on with confidence!

An insurance loss run is a report used to document the insurance claim history of your business. If you have a pristine claim history, you can use that information as a bargaining chip to see if you can land yourself a competitive rate.

If you are looking for a loss run report, you can contact your insurance provider to request one. Make sure you tell them what policy and span of years you are requesting and give them a date you need the report by.

A loss run report resembles a spreadsheet with important information about each claim your business has made including the date each claim was filed and its status (open or closed) along with a claim number, a brief description of each claim, the losses reported, and any settlement costs for past claims.

You need a loss run report to negotiate lower premiums with your existing or new insurance provider, determine risks associated with running your business, and establish a plan to help mitigate potential hazards.

You can get a loss run report from your account manager, insurance broker, agency, or insurance provider.

Kymberlin earned her Bachelor of Arts in Creative Writing from Pacific University in 2020 and resides in Portland, Oregon.

View Kymberlin Bush's professional experience on LinkedIn.

Let us know how well the content on this page solved your problem today. All feedback, positive or negative, helps us to improve the way we help small businesses.