This article is part of a larger series on Bookkeeping.

Table of ContentsWriting a collection letter requires you to follow the right steps and use proper tone and language in your letter. When creating your letter, make sure that it’s concise and to the point, and include all the necessary information, such as the purpose of your letter, a summary of outstanding invoices, and acceptable payment methods. Writing effective collection letters is an important part of extending credit to customers and a best practice for managing accounts receivable (A/R). Typically, you should send out four letters before resorting to a collection agency.

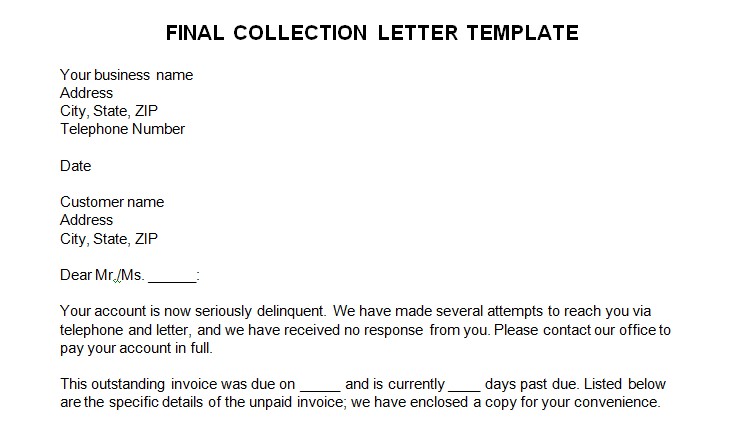

For your convenience, we’ve provided a series of free collection letter templates, which you or your bookkeeper can download and customize with your company logo, mailing address, and other essential information.

Need help with collection letters? Download our four collection letter templates.

FILE TO DOWNLOAD OR INTEGRATE

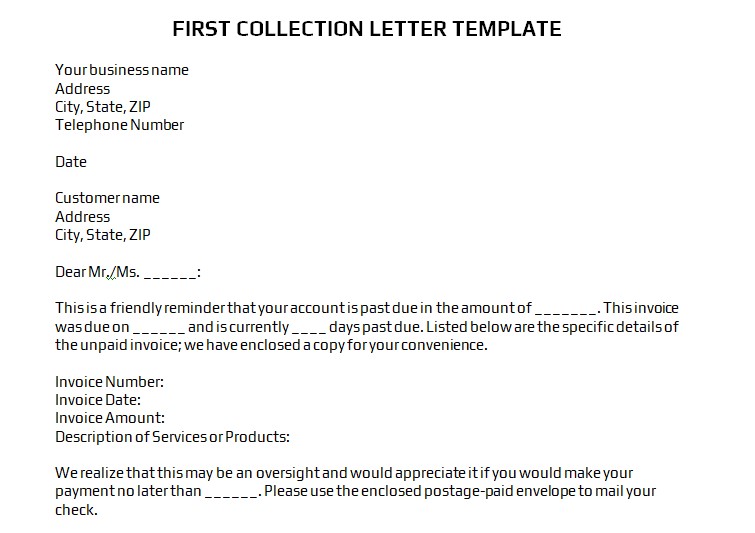

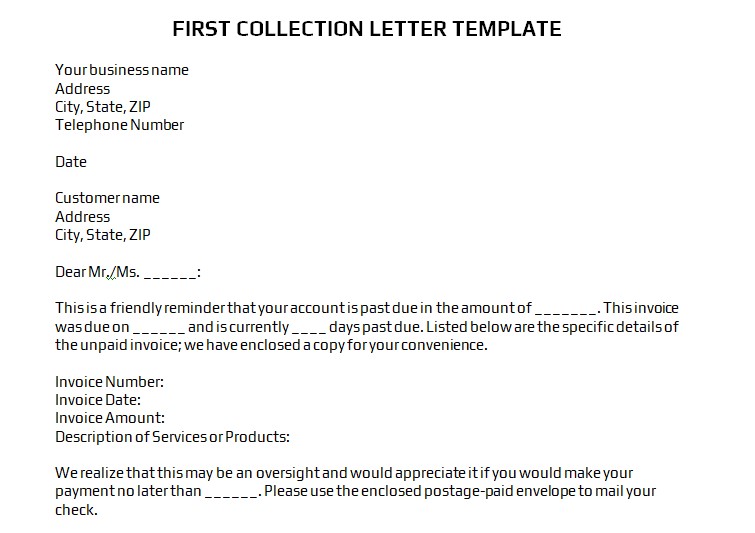

First Collection Letter Template

Download as Word Doc

FILE TO DOWNLOAD OR INTEGRATE

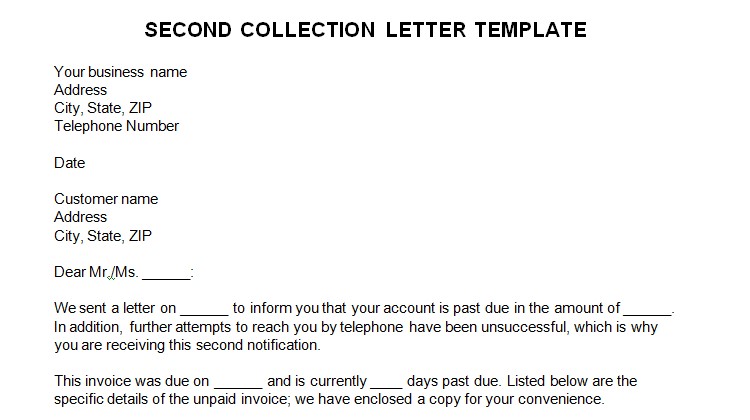

Second Collection Letter Template

Download as Word Doc

FILE TO DOWNLOAD OR INTEGRATE

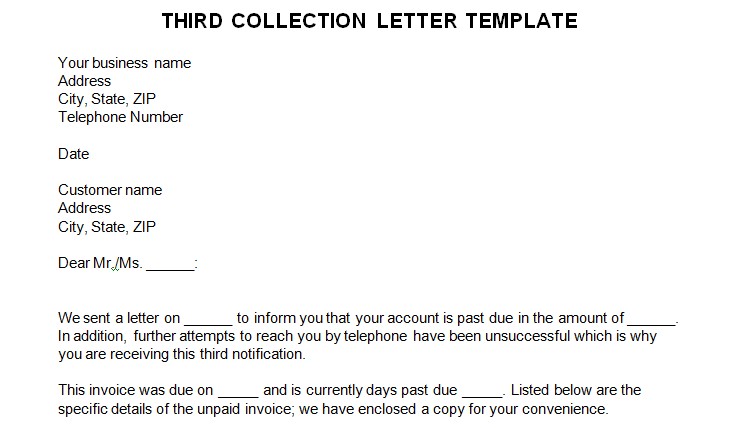

Third Collection Letter Template

Download as Word Doc

FILE TO DOWNLOAD OR INTEGRATE

Final Collection Letter Template

Download as Word Doc

Let’s look at the essential best practices necessary for writing a collection letter:

Collection letters have certain features that make them unique from other types of business letters, such as:

Typically, you’ll send your customer a series of four collection letters before hiring a collection agency or recording a bad debt expense.

The first collection letter should be mailed only after you have tried asking for payment in an email or telephone call. If you’re a QuickBooks Online user, you can email an invoice to your customer to facilitate easy payment. If you need help sending emailed invoices in QuickBooks, read our guide on how to create and send invoices in QuickBooks Online.

If the customer hasn’t made payment arrangements with you after contacting them via telephone and email, you should mail the first collection letter. In general, this should be no later than 14 days after the invoice due date.

Before sending a second collection letter, a telephone call should be made to see if the first letter was received and if the customer would like to make payment arrangements. If unsuccessful, it’s time to send the second collection letter. The primary difference between the first letter and the second is that you will include the fact that you did attempt to reach the customer in the first letter.

After sending the second collection letter, you should attempt to reach the customer by telephone again. If the customer doesn’t respond within a couple of weeks, send a third collection letter. Similar to the second letter, you will include language to inform the customer that previous contact attempts via letters and telephone calls have been unsuccessful, which has resulted in this third attempt.

We also recommend that you send this letter by certified mail. This will require that someone signs for the letter, and it will provide you with proof that the letter was received. This kind of documentation will be important if you have to take legal action to collect this debt.

While there may be some exceptions, by the time you get to a fourth collection letter, it should be painfully clear that your customer is either unwilling or unable to pay their debt. The language will be the most assertive of the letters but should remain professional. Similar to the third letter, you need to send this final collection letter via certified mail.

The first collection letter should be mailed only after you have tried asking for payment in an email or telephone call. If you’re a QuickBooks Online user, you can email an invoice to your customer to facilitate easy payment. If you need help sending emailed invoices in QuickBooks, read our guide on how to create and send invoices in QuickBooks Online.

If the customer hasn’t made payment arrangements with you after contacting them via telephone and email, you should mail the first collection letter. In general, this should be no later than 14 days after the invoice due date.

After multiple attempts to collect on a delinquent account with telephone calls and letters fail, you should consider hiring a collection agency. One thing to keep in mind is that, once you hire a collection agency, you won’t receive the full amount that is owed to you. Generally, collection agencies charge between 25% and 45% of the total amount to be collected. Depending on the amount of the outstanding debt, this may not be worth hiring a collection agency for.

If you decide to just cut your losses and not hire a collection agency, you should go ahead and write the account off as bad debt. This will at least allow you to claim a tax deduction for the amount owed to you if you’re an accrual-basis taxpayer.

A collection letter is proof that you have attempted to collect what a customer owes you. In case it escalates to a collection suit, the collection letters will be considered as hard evidence that your business tried to reach out to the customer.

You can send collection letters via post mail or email. For speed and convenience, we recommend sending via email.

We hope that with this guide, you have learned how to compose an effective collection letter, which can help you get paid while maintaining a positive relationship with the customer. As you have observed from our free templates, the key is to keep it professional and to the point.